charitable gift annuity tax reporting

If you believe the new law may affect your estate or gift tax liability or filing requirement. This is accomplished by having the donor contribute an appreciated asset to a charitable remainder trust and take back an annuity or unitrust interest then having the trust sell the asset and reinvest the proceeds in tax-exempt securities.

Gifts That Provide Income Maine Organic Farmers And Gardeners

Not all charities are DGRs.

. If you are reporting separate trusts defined above on this Form 706-GST explain why you are treating parts of the trust as separate trusts. You may elect alternate valuation under section 2032 for all terminations in the same trust that occurred at the same time as and as a result of. While tax deductible CFC deductions are not pre-tax.

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts. If you do round dollars you must round all amounts. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

Bail Bond Agent General Bail Bond Agent and Surety Recovery Agent Affidavit of Exam Proctor MO 375-0108 Bail Bond Agent General Bail Bond Agent and Surety Recovery Agent Continuing Education Certificate of Course Completion MO 375-0106 Bail. For a sample form of a trust that meets the requirements of a testamentary charitable lead annuity trust see Rev. You may round off cents to whole dollars on your return and attached statements.

Rounding Off to Whole Dollars. Some of the items included on the form are the gross. 78 data Organizations whose federal tax exemption was automatically.

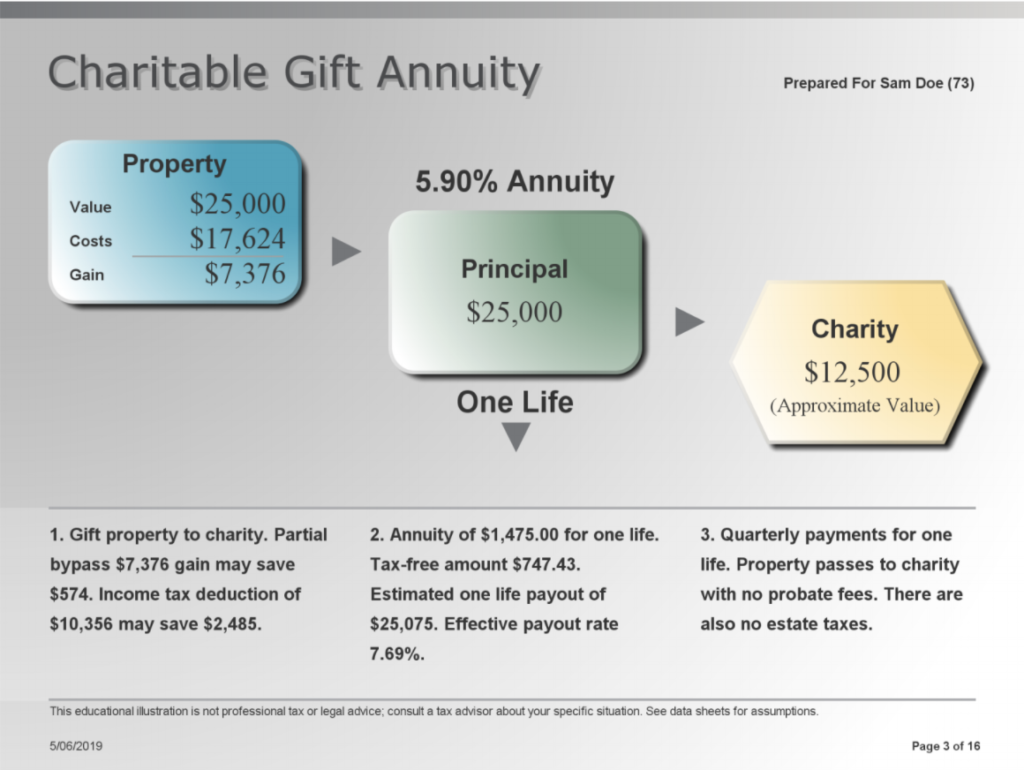

For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes. Charitable Gift Annuity Notification form MO 375-0991 Continuing education forms Bail Bond. Donors should contact a tax advisor for more information.

From the IRS Tax Exempt Organization Search is an on-line search tool that allows users to verify that an organization is tax exempt and check certain information about its federal tax status and filings. Organizations eligible to receive tax-deductible contributions Pub. You may search for.

If in connection with a transfer to or for the use of an organization described in subsection c such organization incurs an obligation to pay a charitable gift annuity as defined in section 501m and such organization purchases any annuity contract to fund such obligation persons receiving payments under the charitable gift annuity shall not be treated for purposes of. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. Assuming there is no express or implied obligation on the trustee to sell the asset and reinvest in tax-exempt securities Rev.

In the United States Form 1099-R is a variant of Form 1099 used for reporting on distributions from pensions annuities retirement or profit sharing plans IRAs charitable gift annuities and Insurance ContractsForm 1099-R is filed for each person who has received a distribution of 10 or more from any of the above.

How Do Charitable Gift Annuities Work Lisbdnet Com

Charitable Gift Annuities Uses Selling Regulations

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Tools Techniques 101 The Charitable Gift Annuity Withum

Gift Annuities Catholic Charities Usa

Life Income Plans University Of Maine Foundation

Charitable Gift Annuity Thinktv

How Do I Deduct A Gift Annuity To A Charity

City Of Hope Planned Giving Fall Annuity

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuities Development Alumni Relations

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center